Major Forces

determining the next

several weeks and months

Tuesday, 29 July, 2025.

Clifford eyeing bubble trouble

- US-EU trade deal delivers major benefits for American business and investment

- Tariffs described as a drag on global growth and key driver of US inflation

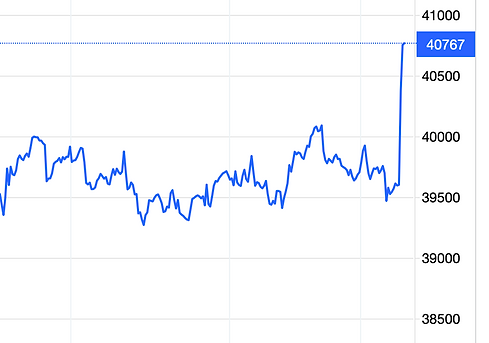

- Market rally seen as liquidity-driven bubble, with additional upside predicted for Dow Jones

- Australian economic outlook remains mixed, with strong export support for the dollar but pressure to cut rates

CNBC Dubai

Trump Tariffs EU and Japan

Bloomberg.com image

Monday, 28 July, 2025.

TODAY

Stocks will be buoyed by Tariffs news, again avoiding the reality of still significant, even arduous tariff levels remaining, including with the 90 day extension re China USA talks,. Today's markets love keeping it simple, to the headlines in fact. Over-looking harsh realities and happy to have a excuse to party, Such is likely to be today's equity market headlines.

The USA take-over of Australia is almost complete. Our iconic cattle industry, rivalled on ly by Argentina, likely to be now averaged down bu a flood of US meat imports and the diseases that will bring here. One already identified as having arrived.

SNAP

US stocks are strong on the back of excessive government spending and the Big Beautiful Bill addition to that.

Tariffs, the biggest impact will be steadily rising inflation in the USA. No Fed cuts this year.

The US dollar is close to a collapse toward Euro 1.22 then 1.3000, especially if Zelensky is ousted by people pressure and peace can come to Ukraine/Europe.

US Treasuries are living on borrowed time.

Australian stocks are a bubble driven primarily by US fund interests buying Australia outright.

Australian dollar in a game of cat and mouse with the other dollar

Gold sideways for months.

Oil is gathering energy for an eventual rally as global demand will outstrip current industry forecasts for years to come.

Australia: desperately needs a new political system. 35% of people voted for current government. Tax levels should be Compnay 20% Income 2-% GSY 20%. There should be ZERO fuel excise tax. the most evil tax in Australian history. Same with land tax and carbon credits tax on property sales. The Queen secretly felt Australia should become a Republic, had grown up, but the two major parties maintain control by not allowing the people a dicrect vote. The Reserve Bank Governor and Board, must be appointed from outside the bank. People should know it is among the very worst and most incompetent central banks in the world. An international laughing stock.

CATERPILLAR INC looks as strong, maybe will be stronger from here than NVIDIA ?

26 July, 2025.

Still cautious of this tired looking SP500 however. Yes, TIRED, it is stumbling to new highs, but looks to be doing so on its knees. This is a worry, and deserves your closer attention.

RISE ABOVE the Wall Street media headlines, the waning momentum of this rally should concern you. It doesn't mean a top is definite, and the Dow Jone could be going to 50,000, as per my home page article, but you really need to be more focussed here than just accepting the daily headline of a new high as meaning the overall US market is invincible?

Increase your attention over this next week as I said last week too. The market needs to leap higher or too many people are going to begin to get a little itchy about taking profits here.

Clifford Bennett

Stocks &

Global Outlook

23 July,2025

Australian Stocks

CBA long term top

25 July,2025

Oil looks to be basing for another run to the upside,

25 July, 2025.

Which could be a further addition to the upward pressure on US inflation already in play due to tariffs. An oil rally would rule out any Fed cuts this year.

Gold fails badly here,

25 July, 2025.

Gold falling back into range here could mean months more of consolidation.

Australian market falls back,

25 July, 2025

Japan and Australian equity markets are soft on the day, as the realisation, that although not the worst case outcome for tariff levels, they are none the less being instated to a harsh degree. US actions will slow global demand, while being firmly inflationary over time in the USA in particular.

For a trading nation like Australia things are a little more tricky going forward. Japan will try to alleviate their impact with a lower Yen, but Trump also wants a lower US dollar. A move below 8625 for become quite concerning for the medium term fate of the Australian market. A significant reversal could be on the cards, just as everyone got super-confident.

AUS200 Daily

UKRAINE: Massive protests against Zelensky government corruption are going largely un-reported in the West.

24 July, 2025.

NATO war footing attempts to control Western media reporting. Usually. The protests are absolutely huge against the entire parliament. Ukrainians can see what is going on with their government and war funding and materials, but we in the West had been happy to remain oblivious and loyal to the simplistic narratives we were offered.

There its a sea change happening, however, and Zelensky will not last long now as Ukraine's President. Who has remained due to cancelled elections after illegally suspending the constitution, as well as banning opposition groups and media outlets.

That Trump is making comments and there is any reporting at all of these protests, there have been several in recent years totally un-reported, is a strong indication Zelensky will soon, in weeks most likely, be leaving office. He reportedly, by seasoned European investigative journalists, has been acquiring several lavish residences in Switzerland, Italy and the Bahamas.

My tip and take is, there will be peace soon after his exit.

This is potentially a powerful boost to the EU economy and currency on the basis of diminished risk of a wider war. Still bullish Euro, against a declining empire greenback. US fiscal largesse, massive deficit, manufacturing depression, isolationist tariffs, new home sales consistently below covid lockdown lows and the list goes on. For foreign investors to fund the deficit, buy dollars, is a big ask. Not without much higher yields. Going short the 10 year in our model portfolio.

For now, in Ukraine, Russia continues to advance rapidly. It really is becoming a case of the sooner Zelensky goes, the more of Ukraine that can be saved through a peace deal.

Markets Overview

23 July, 2025

Stocks have broken up out of recent ranges, but are clearly having a hesitation moment. I really think we get perhaps 10% overall market trends from the current level, up or down, and need to be very keenly focussed over the next few days?

The US dollar could have had its last rally for the year, even as the Fed holds/hikes due to tariffs inflation in the second half.

Gold is building a lot of potential energy that will likely be released to the upside over coming weeks and months.

US500 Daily

US Manufacturing Depression,

23 July, 2025

Fifth district manufacturing one expansion of any kind month in two years. Which is better than most of the country. Thie reality of a deep manufacturing depression is swept under the carpet and has been rarely mentioned by the Wall Street media spin machine. It is very real and a big part of Trumps tariffs push.

Trump approach working,

23 July, 2025

Japan stock market jumps today. This is really very funny and entertaining. How Trump hits people with armageddon, and then when he gives them still harsh tariffs of 15% and a requirement to invest half a trillion dollars into the USA, people react with massive relief and celebration?

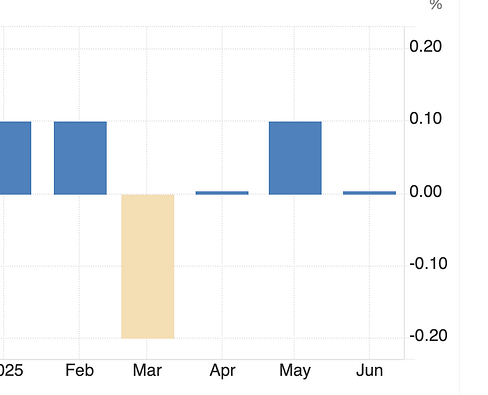

Australia Leading index flatlines.

23 July, 2025.

Read Recession!

Westpac Melbourne Institute Leading Economic Index came in flat. Zero growth outlook. Throw in an Everest of anecdotal info Plus the private sector previous negative GDP print, as well as jumping un-employment, and it is not rocket science to recognise Australia is already in a recession while the RBA 'deliberates'. Another shocking performance from the world's worst, least economically aware central bank.

The RBA saga continues sadly as it has for years.